Savings, not salary

If you ever have the good fortune of comparing two work opportunities, it’s best to consider how each will impact your yearly savings. You should ignore the pre-tax compensation that they represent (i.e., how most offers are presented), as pre-tax total compensation is a vanity metric.

An example

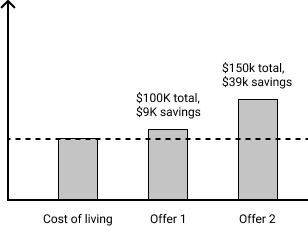

Consider a hypothetical software engineer in San Francisco who has the good fortune to compare two offers: one at $100K and another at $150K.

Before taxes, the larger offer is 50% higher. However, after taxes and expenses, the larger offer is 333% higher in yearly savings. Taking into account taxes ($100K → $71K, $150K → $101K) [source] and a $62K cost of living for San Francisco [source], the engineer’s choice is between saving $9K per year and saving $39K. That’s potentially the difference between having a ~200k down payment for a home in San Francisco after 5 years versus having one after 20 years!

Before taxes, the larger offer is 50% higher. However, after taxes and expenses, the larger offer is 333% higher in yearly savings. Taking into account taxes ($100K → $71K, $150K → $101K) [source] and a $62K cost of living for San Francisco [source], the engineer’s choice is between saving $9K per year and saving $39K. That’s potentially the difference between having a ~200k down payment for a home in San Francisco after 5 years versus having one after 20 years!

If you live in an expensive area, a lot of your income will go toward covering your cost of living. Your income only goes into savings once you cover your cost of living.

Takeaways

- Your savings rate is what matters, not your pre-tax income.

- When negotiating offers, each additional dollar beyond covering your yearly expenses goes into savings. Bumps here can drastically increase your savings.

- Sometimes it makes sense to take the lower paying job. Use this framework to know what you’re giving up.